One of the differences to Japan that I noticed when I came to Australia is that more people here have a job on the side as well as their main job. I have an admin job at a construction company and I also sell a few soy candles. My manager at the construction company has the office job and works as a fitness instructor. I guess not many companies have a rule saying you can’t have a side job. At a previous workplace there was an office worker who also bred snakes. Companies in Japan might not think it’s good for employees to have a side job because it would interfere with their main job, which makes this another area where Australia might be more open and freer. The reason a lot of people do a job on the side is that in Australia anyone can start up a one-man business, even if you don’t have any capital. As long as you have a visa that allows you to stay and work in Australia and you have a tax file number (like Japan’s My Number) you can get an Australian Business Number (ABN), which you need to carry on a business, and then you can sell goods or services, even if you are on a working holiday or student visa. You can apply for a tax file number and ABN by filling out the forms on the Australian government websites. You’re not obliged to get a tax file number, but if you work without one, your income will be taxed at the highest rate. An individual can only get one tax file number, which you keep your whole life, but if you register an ABN then later give up your business, you can cancel the ABN. If you need to, you can register an ABN again. Some individuals have several ABNs, and conversely, you can have several businesses with one ABN (the latter is more common). Plus, apart from using a personal name, you can register your preferred company name yourself as a trading name, as long as it isn’t already being used. The Australian government has a website called ABN Lookup where you can search ABNs by typing in an individual’s name or a company name. The results show when it was registered (registration date), the place of business (the name of the state), whether the business is registered for the 10% goods and services tax, and when the information was last updated, etc. An ABN is something that people starting up a business get, but in some cases, for example, beauticians and massage therapists, many of them work as contractors for a salon or clinic, so getting an ABN is a prerequisite for them. Contract employees and tradesmen called sub-contractors similarly work as contractors for companies using an ABN as an individual. When you issue an invoice, you put your ABN on it. If your annual sales are $75,000 or more, you must pay Australia’s 10% consumption tax (goods and services tax or “GST”). In that case, your charges to customers must include the 10% consumption tax. If under $75,000, you are free to choose whether to register for and pay the GST.

To give a basic explanation of the steps:

You get a tax file number → get an ABN → and register a business name. If you complete these steps, you can sell goods and services after ABN registration; when you make a sale, you issue an invoice; and you can carry on a business earning income.

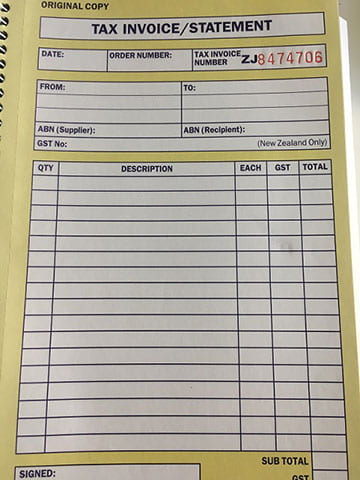

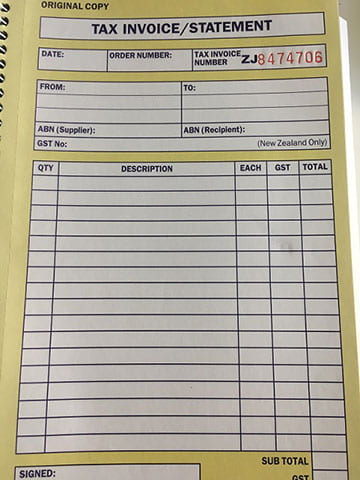

A tax invoice currently in use

There are boxes for filling in the supplier’s and recipient’s ABNs. Sales may also involve GST, so the invoice has boxes for you to fill in the GST (10% goods and services tax).